By Ehsanul Hoq

“China’s goal is not to make payments more convenient but to replace cash, so it can keep closer tabs on people than it already does”

Aaron Brown

In the history of mankind, China has always kept itself isolated. Until, the rise of the Mongols in the 13th century, China was known as a great land of mystery to the west.

Marco Polo’s journey in China and meeting the GREAT KUBLAI KHAN was one of the most famous travel story’s till now. But now in the 21st century, China is still a land of wonders.

China has been blamed for initiating one of the most devastating pandemics of the modern age- SARS-CoV-2, a.k.a, the coronavirus pandemic. But behind the scene, China is equipping itself to become a nation that will be followed by many others.

For instance, China created the BELT AND ROAD INITIATIVE (BRI) to connect China with other countries in the west. When the BRI project will be completed, we will get a single superpower dominating ASIA AND AFRICA bypassing every other possible ASIAN competitor like INDIA, JAPAN, AND INDONESIA.

But do you think only a project with roads and ports will be enough for China? The COMMUNIST PARTY of CHINA is trying to replace every possible sector with Chinese products from tech to currency. This is where the CHINA CRYPTOCURRENCY is coming into play.

China Cryptocurrency: Traditional vs Digital

We saw how cryptocurrency and blockchain became top news in the world when BITCOIN prices spiked in 2017. But the technology was dated back years ago by a mysterious person called Satoshi Nakamoto.

Now in 2020, after years of experiments by many countries like Japan, the U.S, and U.K Satoshi’s crypto technology has been centered in the old and mysterious land of China.

Even before China becoming the capital of cryptocurrency, people used mobile payments like ALIPAY AND WECHATPAY instead of paper currencies.

“In order to implement the FinTech Development Plan (2019-2021), the People’s Bank of China has explored approaches to designing an inclusive, prudent and flexible trial-and-error mechanism.”

THEHINDU.COM

China Cryptocurrency Race 2021

Discussion Guide

- A Pilot Program

- Unwelcoming Reception of Crypto in the Past

- Bitcoin and China

- Why China Wants CBDC

- A Two-Tier CBDC Model

1. A Pilot Program

China reported $20.5 billion in investments in the growing Cryptocurrency sector in Q1’2018. But all of the efforts started with a pilot program in 2014. The program was initiated by the Chinese Central Bank to create Central Bank Digital Currency (CBDC).

So we can trace the interest of China on Blockchain and Crypto technologies back in 2014 when China was facing constant economical pressure. China had to devalue the currency-Renminbi, 2% to stay in track.

So 4 cities have been chosen as a part of the pilot program – Shenzhen, Suzhou, Chengdu, and Xiong’an. These will be the brand new smart cities with smart digital currencies for the citizens.

Already the spread of Covid-19 allowed China to test the intent of people to use a digital version of the traditional currency system. They just don’t want to carry physical money and wallet that might increase the risk of virus contamination.

But we found a few factors that might force the CHINESE GOVERNMENT to launch the digital currency as soon as 2022. Our findings are listed here below-

Fintech Domination

The domination of ALIPAY and WECHATPAY in the Chinese financial markets is a bigger concern for the China Central Bank. They want to curb out the 90% market share of the two giants using the power of the government-backed digital currency.

U.S Hegemony

China has been trying hard to reduce the U.S presence in global politics for years. Although at first things looked quite normal in China recent activities are not favorable for the United States.

China at first separated itself from others using custom-made apps and software for the citizens. Then they showed the world how to make a strong stand against the U.S hegemony in the trade war. Even Chinese companies started competing with the top U.S companies like Facebook and Google.

Winter Olympics 2022

The biggest opportunity for China to test the newly developed government-backed digital currency at the Winter Olympics 2022. I think Beijing will do anything to prove the world that they are capable of transforming an idea into action within a short time.

2. Unwelcoming Reception of Crypto in the Past

The journey of Cryptocurrency hasn’t been smooth. The central banks and governments around the world mocked it for being a money-laundering mechanism. The tether crypto which was created to imitate the U.S Dollar had a roller coaster ride in the past.

Even the most popular digital asset, Bitcoin had been negatively represented by many law-makers. So long before China showed their interest, the world never saw the technology very positively.

But China is looking at it as an opportunity to make a strong digital version of their regular banknote. The wallets Chinese people hold in their pockets will be replaced by smartphone wallets. Moreover, they can perform every financial activity without any BANK ACCOUNT.

It can be good news for the global change-makers who wanted to include millions of third-world poor people on the financial highway. How China will benefit from the inclusion? The study estimates that 225 million Chinese citizens will be a part of the financial inclusion if the national digital currency launches in the new decade.

So we can say that Chinese digital currency will surely challenge the dominating U.S Dollar and Bitcoin. Once China develop a state-owned digital currency it will enjoy three benefits-

- The digital currency will be pegged with the fiat making it more stable than the other digital alternatives.

- China can help Iran to arm itself and avoid U.S sanctions.

- China can finance Asia, Africa, and Middle-East to complete the Belt and Road Initiative and other projects without triggering an alarm at the White house.

Hence, we can say that China walked on a different road where they joined the craze of digital assets rather than beating them.

3. Bitcoin and China

China is indeed seeking a central bank approved digital currency but Bitcoin is also popular in the country. Researches proved that 66% of the BITCOIN MINING operation happens in China. Since China has a massive technological advantage the miners can use the power to mine Bitcoin at a mass level.

Moreover, Bitcoin trading is also popular in China. Some Sources tracked 90% Bitcoin trading in China at different times. The stories of Bitcoin traders becoming millionaires are not rare in both U.S.A and China.

On the other hand, the mobile app companies are 16% of the Chinese GDP comparing to 1%-2% in the U.S.A and the U.K. This gives a huge boost of Bitcoin trading in China for the last few years.

There are reports of making Bitcoin an alternative asset class by the Chinese investors during the 2015-16 stock market bearish stance.

4. Why China Wants CBDC

We will talk in details about Central Bank Digital Currency (CBDC) in the future episodes but for today’s discussion just knowing the following definition is good enough for you-

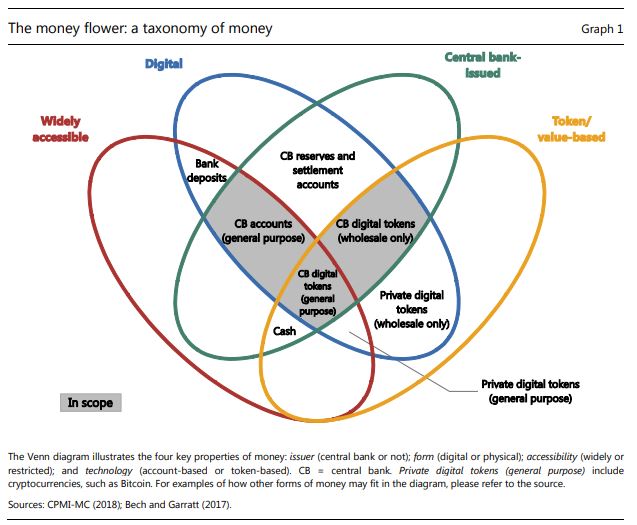

CBDC is potentially a new form of digital central bank money that can be distinguished from reserves or settlement balances held by commercial banks at central banks. –Bank for International Settlements 2018

One study showed that to issue CBDC 25% of the central banks need authority. So it is difficult for any central bank to come up with a CBDC without having the independence to study and implement.

Although the development of CBDC is not possible for many countries it is quite cheaper for the economy. Why is that? Traditional paper-backed currencies eat up our 1%-2% GDP every year for handling charges. The numbers are quite high where a 1% change in GDP can drop you from the rat race of the economies.

As China has been competing with India, Japan, Indonesia, and other growing nations it is safe for them to start working on the CBDC now in the time of the pandemic. What China will get in return?

Firstly, China will boost tax revenue using the CBDC. Digital Currencies are known as an antidote for tax evasion, money laundering, and terrorist financing. Cross-border payment and money laundering issues will be solved.

Secondly, the ability of China to spy all its citizens will improve. If you watch the Documentaries on China you should know how China dominates the minds of the citizens by using surveillance in different forms. But digital currency will ensure China’s financial surveillance in the future. China thinks this will improve national security.

Finally, China will get power analytics on how the citizens from Beijing to Xinjiang use currencies to purchase products and services. This data will be stored in the Central Bank database ready for analysis instantly.

Related Posts:

5. A Two-Tier CBDC Model

So far our discussion proves that China is up to something that might change the balance of the world in upcoming days. But our discussion will be incomplete without introducing you to the Two-tier CBDC model.

The previous digital currencies that came to the market were one-tier assets. That means the contact point of the currency was between the buyer and seller. For instance, if you want to buy Bitcoin you just go to the exchange online and transfer the coins in your digital wallets.

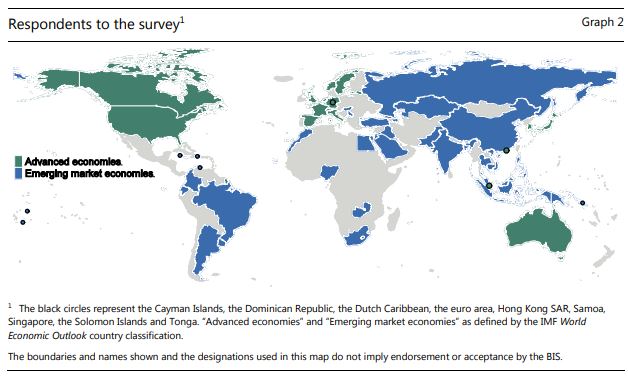

However, the central banks even in the advanced economies had no interest to implement a central bank touchpoint of the digital version. The survey showed central banks are researching but have no intention to implement a CBDC within this decade.

So Chinese scholars came up with a new way to be ahead in the race. They are implementing the two-tier model for CBDC’s where the first contact will be between the central bank and the financial institutions and the second contact will be between the financial institutions and the general public.

This way China will create a strong presence in the digital currency world without devaluing its current economy.

Latest Posts:

- How does news and especially economic news affect Forex trading, what to do about this?

- Top Bitcoin Scams and Failures

- Why China will Lead the Cryptocurrency Race in 2021?

- 10 Hottest digital currencies in the world

- 5 ways digital currency is going to change the business transactions

What to expect in the future

We are almost at the end of our discussion. After going through tons of studies, I can ensure you that China will become a global frontier in the future of our currency. This will not only empower China but also challenge all the nations out there to adopt the new technology within this decade.

There are reports of intentions of the U.S senators to use digital dollars during the distribution of Covid-19 stimulus bills. So we can say that the U.S will response to the situation with strong hands soon when they will see China successfully dominating the digital currency race.

So get ready to see a digital currency war in 2021 when Allies will face China to stop the run before it gets out of control and rebalance the global economy.

Please follow our blog to learn more about digital currencies as we will publish more content in the next few weeks. If you agree or don’t agree with our thoughts please leave a comment below.